Highlights

- The pilot facility, co-funded by ADQ, will test patented technologies for inland shrimp farming, aiming to produce higher-quality seafood in a more sustainable manner

- Partnership with Aqua Development complements ADQ’s ongoing efforts to explore innovative solutions and aquaculture systems that enhance local food production in the UAE's desert climate

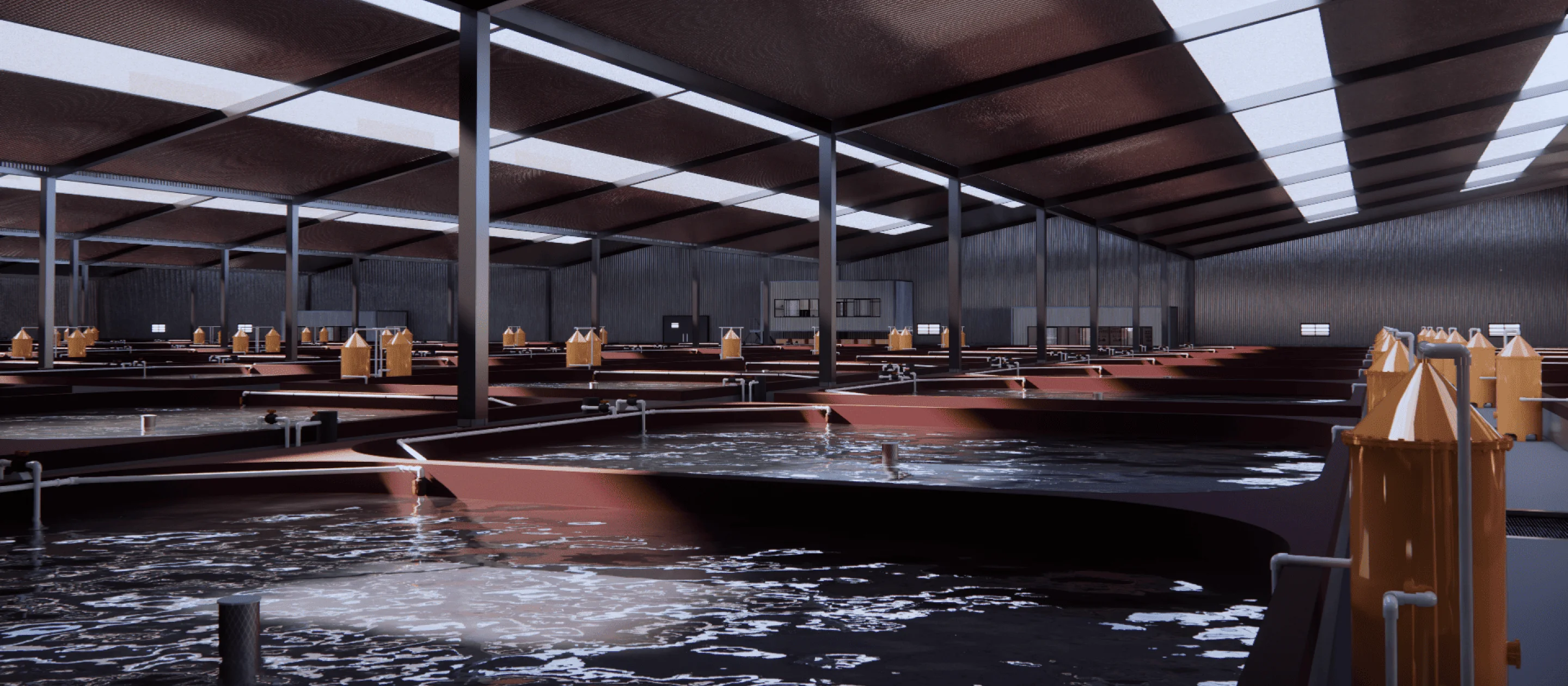

ADQ, an active global sovereign investor with a focus on critical infrastructure and supply chains, has partnered with Aqua Development, a South Korean aquaculture start-up, to explore the feasibility of land-based shrimp farming in the UAE’s climate through the development of a pilot facility to test patented solutions and new agricultural systems. The half-hectare pilot facility is co-funded through ADQ’s Growth Lab, a community of innovators focused on unlocking growth opportunities and driving value creation through innovation and R&D. The facility will be located within KEZAD’s dedicated aquaculture zone, which features specialized infrastructure, utilities, and connectivity.

Under the terms of the agreement, ADQ and Aqua Development will evaluate the prospect of cultivating shrimp – one of the world’s most popular seafoods – onshore, using a combination of aquatic biology and innovation to replicate the shrimp's natural environment. This approach may enable shrimp to grow and thrive more efficiently compared to traditional farming methods, which are labour-intensive and yield low production rates, with modern systems utilizing advanced filtration to recycle water yield higher production rates but do require significant investment. Aqua Development’s patented, modular and nature-based solution reduces costs and delivers up to ten times the productivity of both traditional and modern systems.

Upon successful conclusion of the pilot stage, production is expected to be scaled significantly, marking an important milestone in the local production of shrimp in the UAE.

Approximately 70 percent of the total seafood consumed in the UAE is currently imported. Shrimp is one of the most widely eaten seafoods in the UAE, with 18,700 metric tons consumed in 2023 and a forecasted average annual increase of 4.2 percent, expected to reach nearly 23,000 metric tons by 2029. Despite strong demand for both local consumption and re-exports, domestic shrimp production remains limited to just 1.6 percent of total annual market demand, leading to a high dependency on imports.

Founded in 2017, Aqua Development provides aquaculture development services focused on producing sustainable and high-quality seafood. The company has been operating a facility in South Korea since 2022, which cultivates 60 to 80 tons of shrimp per year. It also plans to establish a facility in Saudi Arabia to further expand its operations in the region.

Mansour AlMulla, Deputy Group Chief Executive Officer at ADQ, said: “Our partnership with Aqua Development underscores our commitment to advancing innovative solutions that address supply chain gaps, strengthening the UAE’s food resilience and self-sufficiency. By leveraging advanced technologies and cutting-edge agricultural systems, this collaboration has the potential to enable sustainable and economically scalable local shrimp production, contributing to meeting the demand for one of the UAE's most consumed and nutritionally dense seafood products while reducing reliance on imports.”

Doohyun Lee, Chief Executive Officer of Aqua Development, said: “ADQ is leading the way toward significant milestones in food security and sustainable food production in the UAE, and we are honored to contribute to this effort. Our ambitions in the UAE are substantial, as we aim to collaborate closely with ADQ and local stakeholders to replace a significant portion of seafood imports with locally produced alternatives by implementing innovative, sustainable, and economically viable aquaculture solutions. Developing and adapting technology tailored to the region's climate conditions presents an exciting challenge, and we deeply appreciate ADQ's trust in this journey.”

According to the UN Food and Agriculture Organization (FAO), aquatic foods constitute 15 percent of the world’s animal protein intake. Global apparent consumption of aquatic foods per capita amounted to 20.6 kilograms in 2021, having more than doubled over the past 60 years. FAO projects that consumption will increase by a further 12 percent by 2032. In 2022 and for the first time in history, global aquaculture surpassed capture fisheries as the main producer of aquatic animals, with aquaculture production reaching an unprecedented 94.4 million tons.

With investments across the entire food value chain, ADQ contributes to bolstering the UAE’s food resilience. Through its portfolio companies, ADQ is working to strengthen the nation’s sustainable agricultural footprint by adopting cutting edge technologies to enable and enhance local production as well as distribution of essential foods domestically and globally.

About ADQ

Established in 2018, ADQ is an active global sovereign investor with a focus on critical infrastructure and supply chains. As a strategic partner to the Government of Abu Dhabi, ADQ invests in the growth of business platforms anchored in the Emirate that deliver value to local communities and long-term financial returns to its shareholder. ADQ’s total assets amounted to USD 225 billion as of 30 June 2024. Its rapidly expanding portfolio encompasses companies across numerous core sectors of the economy, including energy and utilities, transport and logistics, food and agriculture, and healthcare and life sciences.

For more information, visit adq.ae or write to media@adq.ae. You can also follow ADQ on Instagram, LinkedIn, and X.

Established in 2018, ADQ is an active global sovereign investor with a focus on critical infrastructure and supply chains. As a strategic partner to the Government of Abu Dhabi, ADQ invests in the growth of business platforms anchored in the Emirate that deliver value to local communities and long-term financial returns to its shareholder. ADQ’s total assets amounted to USD 225 billion as of 30 June 2024. Its rapidly expanding portfolio encompasses companies across numerous core sectors of the economy, including energy and utilities, transport and logistics, food and agriculture, and healthcare and life sciences.

For more information, visit adq.ae or write to media@adq.ae. You can also follow ADQ on Instagram, LinkedIn, and X.

Direct to your inbox

ADQ News and Insights delivered directly to your inbox

.jpg)

.jpg)