Highlights

- Orion Abu Dhabi is a 50-50 joint venture established to invest in metals and mining companies and to acquire the physical offtake of strategic materials crucial to supply chain security

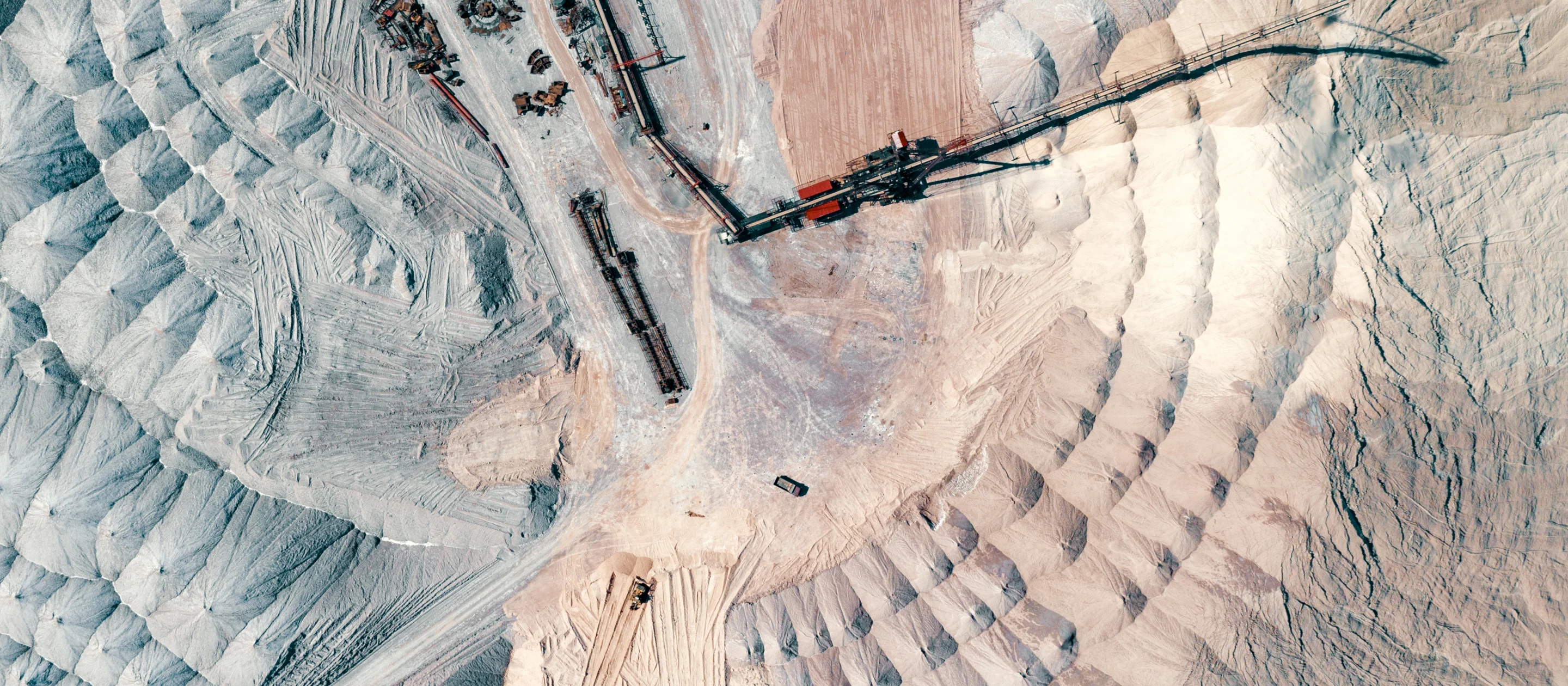

- It will target investments in a range of metals and minerals in various geographies, initially focusing on emerging markets across Africa, Asia and Latin America

- The newly formed entity will be established in Abu Dhabi Global Market, marking the opening of Orion Resource Partners’ fifth office globally

ADQ, an active global sovereign investor with a focus on critical infrastructure and supply chains, and Orion Resource Partners (“Orion”), a leading global investment firm specializing in metals and materials, have entered into an agreement to establish a new Abu Dhabi-based 50-50 joint venture that will make strategic investments in the metals and mining sector to enhance supply chain security both locally and globally. The joint venture partners are committed to deploying an initial USD 1.2 billion of capital over the course of the first four years.

Based out of Abu Dhabi Global Market (ADGM), OMF (ME) JV LP (“Orion Abu Dhabi”) will work towards investing in mining companies through multiple asset classes, including equity, senior debt and production-linked instruments, such as royalties, streams and offtakes. The joint venture will target investments in a diverse range of metals and minerals in various geographies, initially focusing on emerging markets in Africa, Asia and Latin America.

As part of its investment strategy, Orion Abu Dhabi will secure long-term agreements to source essential minerals, including copper, high grade iron ore, and other key commodities important for global supply chain security and the energy transition.

In line with ADQ’s mission to invest in the development of global business platforms delivering value and long-term financial returns for Abu Dhabi, the joint venture with Orion will be part of ADQ’s recently established Infrastructure & Critical Minerals cluster. Also encompassing ADQ’s investments in prominent local and international firms such as Alpha Dhabi Construction Holding and Plenary Group, the cluster aims to contribute to the resilience of the local economy while enabling the continued growth of the wider investment portfolio in other sectors. Downstream sectors such as manufacturing and clean energy are expected to directly benefit from the sourcing of critical raw materials through Orion Abu Dhabi.

As it builds its investment portfolio over the next years, the joint venture is set to derive added value from ADQ’s strong global reach and standing as well as Orion’s deep sector expertise and transactional excellence.

The new office in Abu Dhabi will expand Orion’s international presence to five offices globally. It will be headed by Philip Clegg who has served as Managing Partner at Orion and brings over 20 years of experience in the natural resources and mining investments to his role.

Hamad Al Hammadi, Deputy Group Chief Executive Officer at ADQ, said: “As a long-term investor, we are committed to ensuring that our portfolio companies are set up for success in an ever-changing operating environment. The establishment of Orion Abu Dhabi is a natural step for us, allowing our companies to execute their ambitious growth plans with the assurance of a resilient supply of essential resources. We are confident that Orion’s specialist expertise and strong global network will be a great asset to this partnership and look forward to our shared journey.”

Oskar Lewnowski, Founder and Group Chief Executive Officer of Orion Resource Partners, said: "Over the past decade, Orion has partnered with leading corporations to finance and advance the sustainable production of the resources that are essential to our society. Through Orion Abu Dhabi, we are bringing our successful partnership model to Abu Dhabi to support the security of critical material supply chains, global decarbonization efforts, and to contribute to long-term value for the UAE economy.”

Philip Clegg, Managing Partner of Orion Abu Dhabi, said: “Orion Abu Dhabi is dedicated to investing responsibly in best-in-class mining projects that produce the materials that underpin global economic growth, focusing on megatrends including urbanization, societal development and the energy transition. We look forward to delivering a meaningful contribution to Abu Dhabi’s economic vision through the development of resilient and adaptable supply chains and contributing to the UAE's emerging role as a leader in the global green economy."

ADQ manages over 25 portfolio companies across more than 130 countries. Its portfolio companies operate across key sectors of Abu Dhabi’s rapidly transforming economy, including energy and utilities, food and agriculture, healthcare and life sciences, and transport and logistics.

About ADQ

Established in 2018, ADQ is an active global sovereign investor with a focus on critical infrastructure and supply chains. As a strategic partner to the Government of Abu Dhabi, ADQ invests in the growth of business platforms anchored in the Emirate that deliver value to local communities and long-term financial returns to its shareholder. ADQ’s total assets amounted to USD 225 billion as of 30 June 2024. Its rapidly expanding portfolio encompasses companies across numerous core sectors of the economy, including energy and utilities, transport and logistics, food and agriculture, and healthcare and life sciences.

For more information, visit adq.ae or write to media@adq.ae. You can also follow ADQ on Instagram, LinkedIn, and X.

Established in 2018, ADQ is an active global sovereign investor with a focus on critical infrastructure and supply chains. As a strategic partner to the Government of Abu Dhabi, ADQ invests in the growth of business platforms anchored in the Emirate that deliver value to local communities and long-term financial returns to its shareholder. ADQ’s total assets amounted to USD 225 billion as of 30 June 2024. Its rapidly expanding portfolio encompasses companies across numerous core sectors of the economy, including energy and utilities, transport and logistics, food and agriculture, and healthcare and life sciences.

For more information, visit adq.ae or write to media@adq.ae. You can also follow ADQ on Instagram, LinkedIn, and X.

Direct to your inbox

ADQ News and Insights delivered directly to your inbox

.jpg)

.jpg)